Can We Rescue Trapped SOL from Pump.Fun?

Exploring Dormant Liquidity in Solana’s Memecoin Market

Overview

Pump.fun is a platform that allows users to create and trade meme tokens on the Solana blockchain. Launched in January 2024, it quickly gained traction within the crypto community due to its low barrier to entry. Anyone can launch a memecoin for just 0.02 SOL without needing to provide initial liquidity.

Pump.fun’s model is both creative and polarizing. Its user-friendly interface, bonding curve pricing, and built-in trading terminal fueled the 2024 memecoin mania, although the platform has faced criticism over frequent rug pulls and a lack of accountability.

Early in its lifecycle, Pump.fun introduced a live streaming feature that encouraged users to perform outrageous stunts to promote their tokens. Although short-lived, the feature fueled even more hype with many comparing the phenomenon to an episode of Black Mirror, further intensifying the platform’s explosive growth in 2024.

Token creation on Pump.fun follows a simple process: users submit a name and symbol, pay a small fee, and instantly launch a token. Thanks to its automated bonding curve, each token starts with a predefined price and locked liquidity, eliminating the need to create a trading pool. As more buyers enter, the bonding curve algorithm increases the token’s price. When a token’s market cap reaches $69,000, an automated “graduation” is triggered. At that point, the platform injects liquidity into Raydium (now PumpSwap) and locks it permanently by burning the Liquidity Provider (LP) tokens.

This graduation process leads to a key question:

how much SOL remains trapped in token vaults that fail to graduate within Pump.fun?

Identifying Ungraduated Tokens

To answer this, we begin by identifying all tokens that have been created but not yet graduated. The pumpdotfun_solana.pump_call_create table on Dune provides a complete history of token creation including contract address, creator wallet, token name, symbol, and bonding curve vault addresses. Although it is possible to query Solana's raw instructions directly, using these decoded tables significantly improves performance and simplifies the analysis.

Source: Dune Dashboard

Key columns in the pumpdotfun_solana.pump_call_create table include:

account_mint: Token contract addressaccount_user: Token creator addressname: Token namesymbol: Token symbolaccount_bondingCurve: Bonding curve contract addressaccount_associatedbondingCurve: Token vault address

To identify which tokens have graduated, we can reference the pumpdotfun_solana.pump_call_withdraw table. By performing a LEFT JOIN on the bonding curve address, we can determine whether each bonding curve is present in the withdraw table, which serves as the indicator for graduation status:

(w.account_bondingCurve IS NOT NULL) AS graduation_statusDaily Balances and Time Series Construction

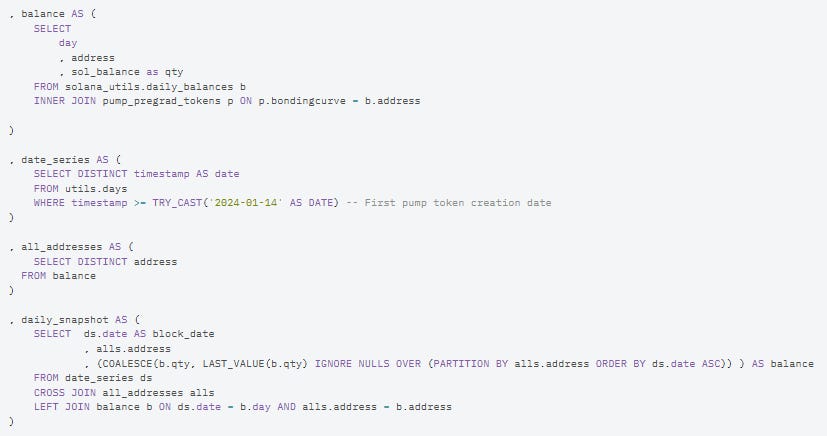

With ungraduated bonding curve addresses identified, the next step is to analyze how much SOL remains locked in each one. The solana_utils.daily_balances table on Dune provides daily SOL balances for Solana accounts. However, this table only logs days when a balance changes so it does not provide a continuous historical record for each address.

To build a complete time series of bonding curve balances, we begin by creating a sequential date series starting from January 14, 2024 (the date of the first Pump.fun token). This date range is then cross-joined with the set of ungraduated bonding curve vault addresses. The result is a comprehensive matrix that pairs every vault with every day since the platform’s inception.

Balances are then joined by bonding curve address and date. To account for days without activity, we apply a forward-fill technique using the following SQL expression:

COALESCE(b.qty, LAST_VALUE(b.qty) IGNORE NULLS OVER (PARTITION BY alls.address ORDER BY ds.date ASC)) AS balanceThis logic ensures that if no activity occurred on a specific day, the last known balance is carried forward. With a complete and continuous dataset, we can then aggregate daily balances across all ungraduated bonding curves to calculate the total amount of idle SOL over time.

“Trapped” SOL Liquidity in Pump.fun’s Bonding Curves

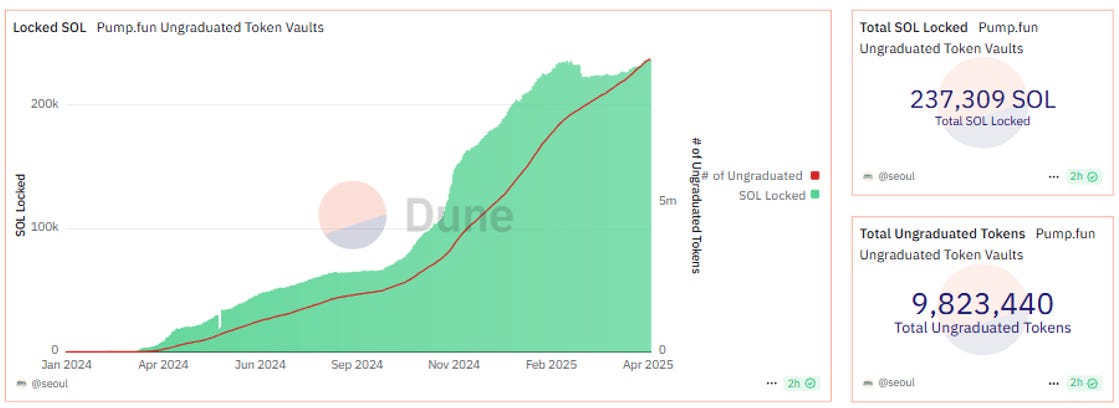

Since its launch, Pump.fun has seen approximately 9.9 million tokens created, with only 1.25% graduating. This leaves about 9.8 million ungraduated tokens, and the number is increasing every day. Data shows that ungraduated bonding curves collectively hold around 237,000 SOL, equivalent to roughly $36 million at a price of $150 per SOL. This figure represents a substantial pool of unrealized and potentially abandoned capital.

To better understand how long SOL remains inactive in bonding curves, we can calculate the most recent date of balance activity for each bonding curve. Based on the number of inactive days since the last movement, token vaults are grouped into the following categories:

Under 30 days

30 to 60 days

60 to 90 days

Over 90 days

About 67,000 SOL belongs to vaults that have been inactive for fewer than 30 days, while 71.2% of vaults have shown no movement for over a month. This indicates that most SOL in these bonding curves has remained idle, which points to the presence of possibly abandoned liquidity in the ecosystem.

Similarly, ungraduated tokens can be analyzed through the lens of token age. By grouping tokens based on their creation date, we can calculate how much SOL is locked in bonding curves across defined age brackets. This breakdown helps us understand whether idle capital is more heavily concentrated in newer tokens that may still be in active development or in older tokens that have likely been abandoned. Token age analysis complements inactivity metrics and helps form a more comprehensive picture of token vaults in the Pump.fun ecosystem.

The metrics reveal that only about 10% of trapped SOL belongs to vaults created within the past 30 days. The vast majority, about 213,000 SOL, has remained in bonding curves for longer. This confirms that most trapped liquidity is concentrated in older and stagnant projects rather than in newly launched tokens.

Here are some interesting patterns and observations:

Within 9.9 million ungraduated tokens’ bonding curves, approximately 237,000 SOL (~$36 million) remains locked

71.2% of ungraduated tokens have been inactive for more than a month

Aged tokens (30 days+) hold the majority of the trapped capital with around 213,000 SOL out of the total 237,000 SOL

Closing Thoughts

The analysis reveals a major inefficiency: a significant amount of SOL is effectively trapped in inactive bonding curves, which raises the question of whether there is a viable way to repurpose or reclaim this locked capital. One potential solution is to introduce thresholds that prompt token creators to act after extended periods of inactivity. If no response is received, Pump.fun could reallocate unclaimed SOL to fund new initiatives or reward active users. However, such intervention risks undermining the platform’s decentralization and creator autonomy.

Without a recovery mechanism, the trapped SOL may effectively be considered unintentionally burned. Although it is technically possible to extract SOL from individual bonding curves, the process could be inefficient and impractical at scale. Pump.fun ultimately faces the challenge of balancing the recovery of idle capital with maintaining its permissionless, decentralized principles. In a cooling memecoin market, addressing trapped liquidity could be key to sustaining Pump.fun’s long-term viability.